Ramp’s automated outbound team, one of the earliest AI SDR programs, used to be a closely-kept secret. It got started in 2021 and at its height accounted for 30% of Ramp’s pipeline, which is a phenomenal success considering how quickly Ramp soared to more than a billion in revenue. And Ramp just shut it down. Returns plateaued as competitors caught up.

Rippling found their programmatic outbound was burning through their TAM. They needed a higher touch and higher conversion channel in order to maintain hyper-growth, via CRO Matt Plank. They’ve since hired more than 150 outbound SDRs to cold call into target accounts, and have seen conversion increase from <1% to between 3-7%.

These are two examples of a broader pipeline crisis being felt across the industry. The GTM channels that worked before don’t necessarily work today. And even the channels that seem to work all of a sudden stop working as product categories mature and competitors catch up.

I recently teamed up with Maja Voje to survey 195 B2B GTM leaders and collect objective data about what’s happening. I shared the highlights earlier in the State of B2B GTM report. Today I’ll break down which GTM channels I’m betting on in 2026, and how they differ for early-stage startups compared to mature scaleups. (A spoiler: intimate in-person events.)

What’s working for early-stage B2B startups (<$10M ARR)

Roughly half of those surveyed were early-stage startups with less than $10M ARR. These respondents said they have 4.7 core GTM channels and another 6.2 GTM channel experiments. (This sounds exhausting, but is actually fewer than later-stage scaleups.)

The most popular core channels for early-stage B2B startups include LinkedIn (67%), founder brand (53%), warm outbound (49%), SEO (45%), and intent-based outbound (37%).

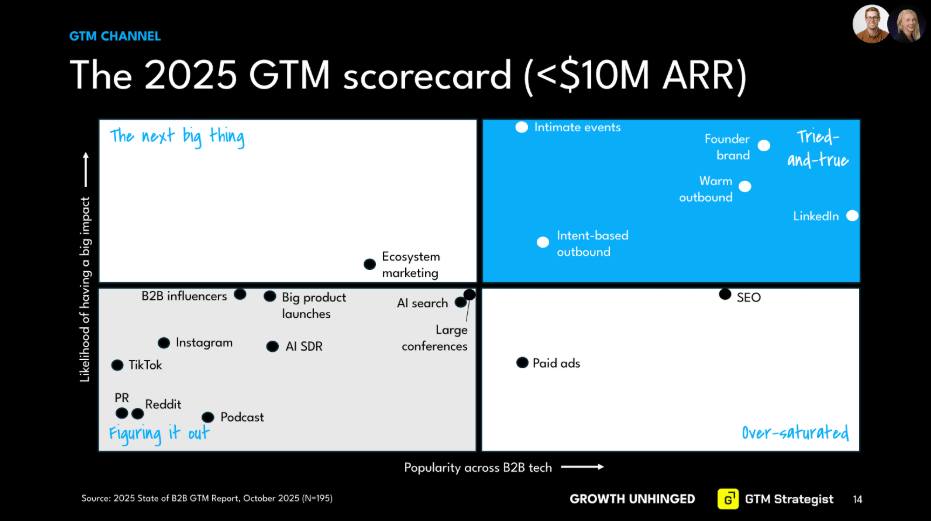

But popular doesn’t mean effective. I mapped how popular different GTM channels are (horizontal axis) versus how likely they are to be seen as impactful among adopters (vertical axis). The shorthand for interpreting what I’m calling the inaugural GTM scorecard:

Tried-and-true channels: Upper right

Over-saturated channels: Lower right

The next big thing channels: Upper left

Figuring it out channels: Lower left

Perhaps unsurprisingly, startups are struggling with SEO. Search volume has plateaued and searchers are reading AI overviews instead of clicking on blue links. More said they’re disappointed by their SEO investments than said these are impactful. Paid advertising similarly fell in the over-saturated quadrant.

The other popular GTM channels earned a spot in the tried-and-true quadrant with the combination of founder brand, LinkedIn, and warm outbound proving to be particularly effective.

The channel that consistently performed best might surprise you. It’s intimate in-person events (think: regional dinners, happy hours, meetups, hackathons). While intimate events are only a core GTM channel for 36% of early-stage startups, nearly everyone who invested here said they were happy with the results.

What’s working for B2B scaleups (>$10M ARR)

Let’s shift to more mature scaleups above $10M ARR. For these companies channel fatigue is no joke. The average scaleup said they have 6.8 core GTM channels and another 6.3 GTM channel experiments. That’s more than 13 channels! I’d argue that if 6.8 channels are core, it means that most companies are struggling to find places to double down that are both repeatable and cost effective.

The most popular core channels for B2B scaleups include large conferences and tradeshows (80%), LinkedIn (78%), SEO (74%), paid ads (66%), and intimate in-person events (59%).

Outbound, particularly automated outbound via email, fell in the over-saturated quadrant as scaleups expanded beyond $10 million ARR (as Ramp and Rippling experienced). The most likely buyers were probably already targeted multiple times over. Scaleups generally compete in more mature product categories, too, which means in-market buyers are getting inundated by countless competitors who all have access to similar intent data.

While still popular, LinkedIn stops becoming a growth channel. Founders now have less time to spend crafting highly personal posts. The algorithm starts to feel like it’s working against you. LinkedIn remains part of the mix, but isn’t going to be what gets scaleups to $100 million.

There’s a positive amidst the doom-and-gloom. Large conferences and intimate events are two of the five tried-and-true channels as we start 2026. Events have bounced back in a major way as people crave personal connection as an antidote to AI slop. While event marketing has always been expensive and resource-intensive, scaleups are large enough to efficiently tap into them.

Two less talked about channels broke into the top right quadrant for scaleups: big product launches and ecosystem marketing.

Big product launches can cut through the noise. Splashy AI demos are attracting substantial interest with launches like OpenAI’s “12 Days of OpenAI” becoming must-see viewing. When done well these launches activate multiple channels at the same time including social media, outbound, inbound, influencers, and events.

Ecosystem partnerships can be tougher to pin down. These could range from informal collaborations (ex: co-branded webinars with complementary companies) to highly strategic partnerships (ex: reseller agreements or marketplace partnerships). In my experience, ecosystem partnerships are one of the few things that get easier with growth. Everyone wants to partner with the emerging market leader; seemingly nobody wants to risk their reputation on an unknown entity.

Where to invest more in 2026

The channels that are working today are starting to become clear. But where are investments going, and which channels are at the biggest risk of becoming oversaturated in 2026?

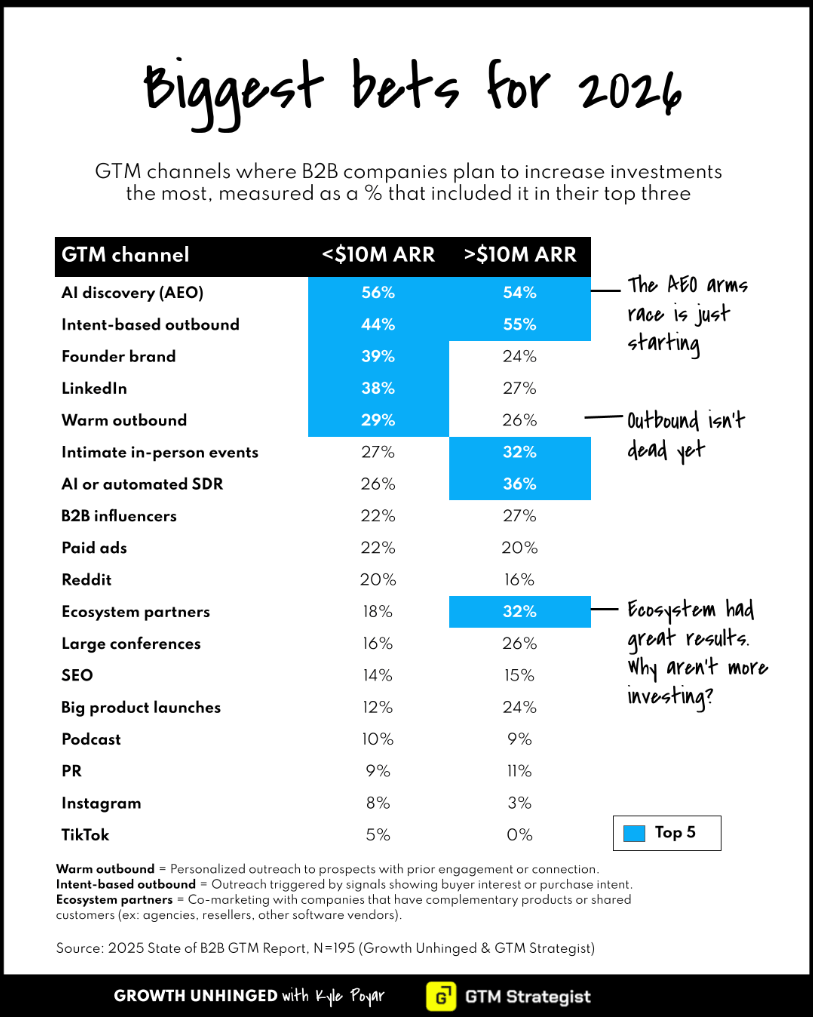

Respondents selected the top three channels where they plan to increase GTM investments the most. There were two runaway winners: AI discovery (AEO) and intent-based outbound.

A thought exercise to start the year: if you couldn’t invest in a single new channel in 2026, what would you do differently to hit your growth targets?

AI discovery has had a breakout 2025. In my conversations with GTM leaders I’ve consistently heard this is the fastest-growing source of high-intent leads. AEO efforts now generate 10% of Webflow’s signups (4x growth year-on-year) and 13% of Docebo’s high-intent leads (4x growth as well), to name just two examples. This isn’t necessarily the biggest source of leads at the moment; however, if these growth rates continue it might be by the end of 2026.

Intent-based outbound is having a moment, too, although this might be surprising given that it’s already an over-saturated channel for scaleups. I’m noticing that basic intent signals are commoditizing (think: fundraising announcements). But the race is on to find first party or highly bespoke intent signals that aren’t available to others. The outbound message essentially writes itself and still gets a reply, when backed by a compelling enough signal.

2025 was a year of near-endless channel exploration. Some channel exploration is useful and even necessary, particularly for early-stage startups or when new channels emerge such as AI discovery. And what works well for the average B2B company could perform terribly for your product or market.

There are (at least) two elements to finding the best GTM channels: channel-company fit (which we’ve covered here) and channel execution. Too much channel exploration sets you up for distraction and wasted effort. It means you’re not investing enough in the program spend and expertise to make your existing channels work to drive the maximum possible impact.

A thought exercise to start the year: if you couldn’t invest in a single new channel in 2026, what would you do differently to hit your growth targets? I bet you could get much more out of what’s already working, which is systematically under-appreciated relative to working on something new.

Resolve to make 2026 the year of ruthless scaling and exceptional execution. It’s becoming clear where to place your bets. But are you ready to go all-in?

Agree? Disagree? Have an opinion?

This Week Across Topline

Meet The CEO Automating Billions of Tasks | Zapier CEO

Wade Foster is the CEO Zapier. They’re an AI agent and automation platform that’s successfully competing in the agent wars.

Foster shares his thoughts on AI agent implementation, agents he likes using, and competing in the AI wars without venture capital.

Usage-Based Comp, AI, and the End of the SDR (Tyler Will, VP of RevOps @ Intercom)

Tyler Will (VP RevOps, Intercom) breaks down how Intercom overhauled its go-to-market engine after shifting to AI-first products.

2026: The Year the Market Clears

Liquidity is returning, but not at yesterday’s prices. What clearing markets, honest math, and longer time horizons mean for founders in 2026.

This Made Us Think

Lemkin shares insights from Philip Lacor's (CRO of Personio) talk on their AI transformation journey while at SaaStr AI London. It's chalk full of nuggets for revenue leaders exploring how to actually get value out of AI. I love the use cases listed, specifically ways to automate and get insights from win/loss intel.

Anthropic announced their latest tool, Cowork, to be a more accessible version of Claude Code. This seems like an interesting new tool to their catalog, but they explicitly call to it's dangers; you must be extremely clear when prompting, lest you want it to be riddled with errors and missing files. AI is getting smart, but we have to hold the steering wheel. Read about it here.

Slackbot (Slack's automated assistant) is now an AI agent. Salesforce CTO, Parker Harris, said, “It’s powered by generative AI, and it is something that is highly crafted and highly curated to be an agentic experience that employees and users love.” They've internally tested for months and are rolling it out. Have you tried it yet?

Editor | Conductor | Imagery |

|---|---|---|

Become a Topline insider by joining our Slack channel.

We want to hear your feedback! Let us know your thoughts.